Financial RSS Feeds

https://www.investing.com/rss/news.rss

https://cointelegraph.com/rss

Investor sentiment in crypto is now at the same level it was during the 2022 Terra-LUNA crash that sent shockwaves through the crypto market.

Bitcoin price analysis stayed bearish on the outlook for BTC, predicting new macro lows in a repeat of the 2022 bear market.

https://www.coindesk.com/arc/outboundfeeds/rss/

https://cryptobriefing.com/feed/

Tether's new stablecoin aims to transform liquidity and bridge the gap between crypto and traditional finance.

The post Paolo Ardoino: Stablecoins are core financial infrastructure, Tether’s USAT enhances liquidity for US users, and the inevitability of stablecoin adoption | The Wolf Of All Streets appeared first on Crypto Briefing.

Block's workforce reduction reflects a broader tech industry trend of streamlining operations amid economic challenges and strategic shifts.

The post Jack Dorsey’s Block may cut workforce by 10%: Report appeared first on Crypto Briefing.

https://bitcoinist.com/feed/

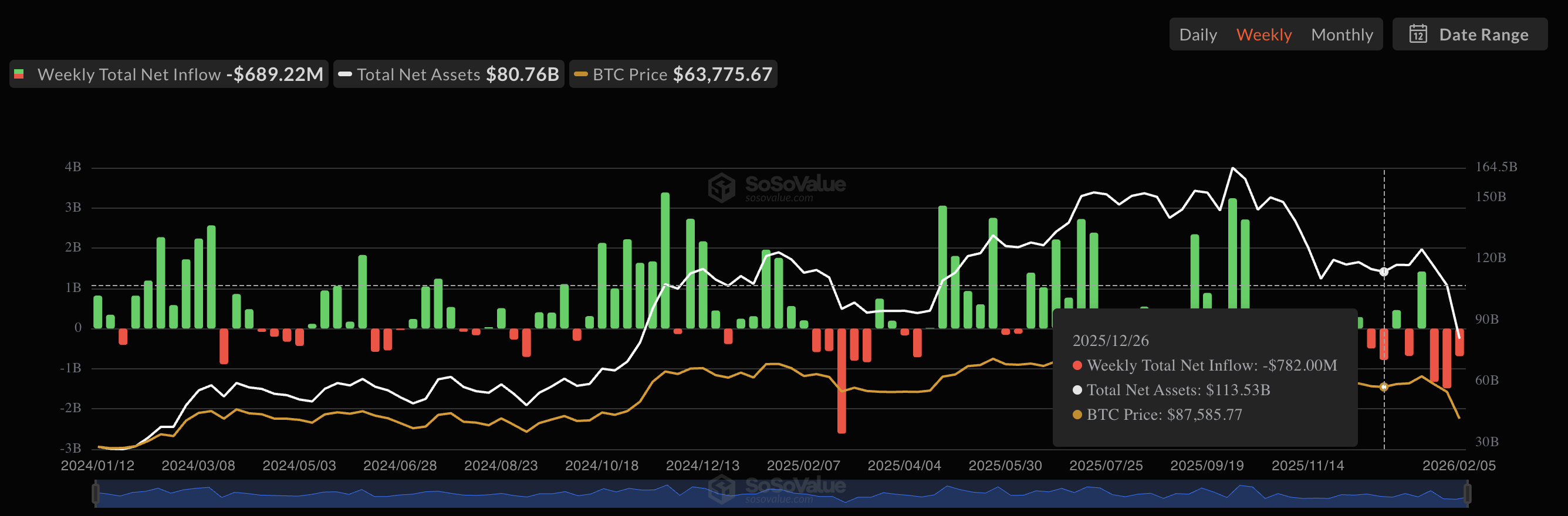

After a chaotic week for the cryptocurrency market, the US-based Bitcoin ETFs (exchange-traded funds) saw significant capital inflows on Friday, February 6. As the flagship cryptocurrency and the rest of the market suffered huge declines, the BTC-linked exchange-traded products also posted substantial withdrawals during the week.

With the bear market confirmed by the latest steep price decline, it would be interesting to see how the US Bitcoin ETFs would perform during their first extended period of downward price action. To give perspective, the BTC exchange-traded funds have had 11 days of capital inflows so far in 2026.

US Bitcoin ETFs Post $330M Net Inflows

According to the latest market data, the US Bitcoin ETFs saw a total net inflow of $330 million on Friday. This round of capital influx comes after three days of heavy withdrawals from the BTC exchange-traded funds over the past week.

While the market data for Friday’s activity remains incomplete, it comes as little surprise that BlackRock’s iShares Bitcoin Trust (with the IBIT ticker) led this round of capital inflows. According to SoSoValue’s data, the exchange-traded fund added $231.62 million in value to close the week.

Furthermore, Ark & 21Shares’ (ARKB) followed in second place, with a total net inflow of $43.25 million on the day. Meanwhile, Bitwise’s Bitcoin ETF (BITB) and Grayscale’s Bitcoin Mini Trust (BTC) registered $28.7 million and $20.13 million in total net inflows, respectively, on Friday.

Invesco Galaxy Bitcoin ETF (BTCO) was the only other Bitcoin ETF that registered activity on the day, posting a total net inflow of $6.97 million. As inferred earlier, these figures come in stark contrast to the performances seen earlier in the week.

It is worth mentioning that this capital influx seen by the Bitcoin ETFs coincided with the price of Bitcoin reclaiming the $70,000 level on Friday. Meanwhile, it is no coincidence that the Coinbase Premium, an indicator of demand from United States investors, flipped positive going into the weekend.

According to data from SoSoValue, this $330 million performance also brought the weekly record to around $350 million in negative outflows. Notably, the $561 million capital inflow recorded on Monday, February 2, also played a part in the final weekly figure.

Bitcoin Price At A Glance

After briefly reclaiming the $70,000 mark on Friday, the premier cryptocurrency has cooled off over the weekend. As of this writing, the price of BTC stands at around $68,900, reflecting an over 1% decline in the past 24 hours.

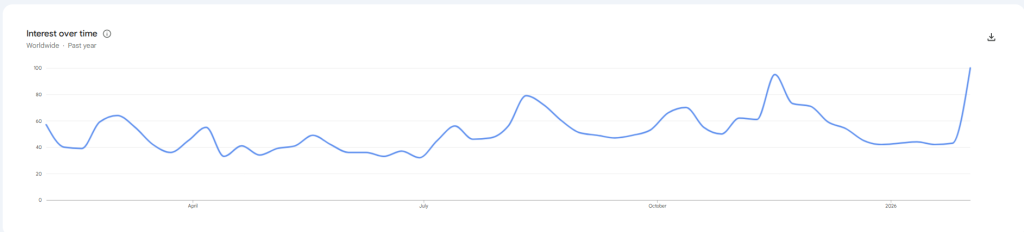

Bitcoin has popped back into public view this week as people flock to search engines to check prices and news. Reports say global Google searches for the word “Bitcoin” climbed to the highest level seen in about a year, a jump that lines up with a stretch of heavy price swings and renewed chatter across social channels and exchanges.

Search Interest Reaches One-Year High

According to Google Trends data analyzed by market outlets, the search index for Bitcoin hit the top score of 100 starting the week of February 1, 2026 — the peak level recorded in the past 12 months.

That index spike came as Bitcoin’s price moved sharply over a few days, pulling more everyday investors and curious readers back into the conversation. Reports note the timing and magnitude of the search jump as a clear sign ordinary users are paying attention once again.

Price Whipsaws Spark Curiosity

Bitcoin’s market action has been bumpy. Based on reports, prices slid from roughly $81,500 down to about $64,000 in early February before recovering into the low $70,000s, and that roller-coaster helped fuel the online interest surge.

When big moves like that happen, people who normally watch from the sidelines tend to look for quick updates, how-to guides, and platform reviews — which shows up as higher search counts.

Retail Attention Shows Up In DataAnalysts and some market watchers have pointed out that spikes in search volume often track with retail attention. Based on reports citing market commentators, the uptick has been interpreted as “retail is coming back,” a shorthand used to describe more individual traders and casual investors logging into apps and reading headlines.

While search numbers don’t say what people will do next, they do reveal a burst of interest that can amplify short-term price pressure.

What Traders And Analysts SaySome traders are watching whether the renewed curiosity will solidify into longer-term demand or simply mark a short-lived return to headlines.

Reports note that past patterns show peaks in search activity often happen during sharp upswings or steep drops, so attention alone isn’t a reliable signal for where prices head next.

Still, a rise in public interest can mean higher on-ramps for new money into the market — and that changes the balance of buyers and sellers for a time.

Quick TakeawaySearch trends show people are watching Bitcoin again. That matters because attention can feed price moves, at least for a while.

For those tracking markets, the next few sessions will reveal whether this burst of searches turns into sustained buying, or whether it ends as another short news cycle.

Featured image from Unsplash, chart from TradingView

https://cryptoslate.com/feed/

Bitcoin’s next big options gravity well sits on Mar. 27 (260327), and the reason is simple: this is where the market has parked a thick stack of conditional bets that will need to be unwound, rolled forward, or paid out as the clock runs down.

The Mar. 27 expiry carries about $8.65B in notional OI and flags $90,000 as max pain, a rough reference point for where, in aggregate, option holders would feel the most pain at settlement.

The broader options complex is enormous, with total BTC options open interest around $31.99B across exchanges, led by Deribit at roughly $25.56B, with the rest split across CME, OKX, Binance, and Bybit.

That concentration can shape how price behaves on the way there, particularly when liquidity thins and hedging flows start to matter more than anyone wants to admit.

Options can often sound like some kind of private language of institutional traders, which is convenient right up until they start influencing spot price. Our goal here is to translate a crowded derivatives calendar into something legible: where the bets are concentrated, how that concentration can change behavior in spot markets, and why March 27 stands out.

March 27 and the shape of the bets

On Mar. 27 (260327), data shows more calls than puts, roughly 69.85K calls versus 53.25K puts, with puts carrying far more market value than calls in that moment.

That combination might look strange and even contradictory, until you translate it into everyday incentives.

Calls can be plentiful because they offer defined-risk upside exposure that feels emotionally painless to hold, while puts can be more expensive because downside protection is often bought closer to where it actually hurts, and it tends to get repriced more aggressively when the market is nervous.

The volume data adds a second clue about what was happening at the margin. For the same Mar. 27 expiry, CoinGlass data shows puts around 17.98K versus calls around 10.46K in trading volume, again with puts carrying the heavier market value.

That tells us the flow that day leans more toward paying for protection than chasing upside, even while the outstanding inventory still looks call-heavy on count.

Now place that against spot and the broader pile.

March can feel far away in calendar terms, especially when the market is this volatile, but in options terms, it's close enough to exert gravity once nearer expiries finish shuffling positions forward.

When one date holds several billion in notional, it becomes a focal point for rolling, hedging, and all of the other quiet mechanical work market makers do to stay roughly neutral as customers buy and sell convexity. While this doesn't guarantee a particular price, it does increase the odds of price behaving as if there are invisible grooves in the road, because in a derivatives-heavy market, hedging flows can add friction in some ranges and remove it in others.

That brings us to max pain. It's a bookkeeping-style calculation across strikes, not a law of nature and not a trading signal with a motor attached.

It can be a useful reference in the way a median can be useful, as a single marker that tells you something about the distribution, but it's blunt, and blunt tools are almost never the ones moving price.

What tends to matter more is where positions are crowded by strike, because crowding changes how much hedging needs to happen when spot moves. CoinGlass data shows a put/call ratio around 0.44, one more hint that the distribution is lopsided rather than smooth, and lopsided is the whole point because it's how a date stops being a calendar fact and becomes a market event.

There's a simple, non-trader way to hold all of this without turning it into fortune-telling.

As March approaches, crowded strikes can behave like zones where price movement feels oddly damped, then oddly jumpy, because the hedging response is not steady.

If Bitcoin wanders into a heavily populated region, the market’s automatic risk management can reinforce a range, and if Bitcoin moves hard enough to escape it, those same mechanics can flip into something that amplifies momentum instead of resisting it.

What's gamma doing while everyone argues about max pain

If options talk has a single word that scares off otherwise capable people, it's gamma, which is unfortunate because the idea is straightforward when you keep it tied to consequences rather than algebra.

Options have deltas, meaning their value changes with price, and gamma describes how quickly that sensitivity changes as price moves.

Dealers who sit on the other side of customer trades often hedge to reduce directional risk, and the practical version is that hedging can turn them into automatic buyers on dips and sellers on rallies near crowded strikes. This is one of the clearest explanations for why price can look magnetized to certain regions.

The reason this matters for a large expiry like Mar. 27 is that hedging intensity isn't constant through time.

As expiry approaches, near-the-money options tend to become more sensitive, and that can make hedging adjustments more frequent and more meaningful in size. That's where the idea of pinning comes from, the observation that price can spend suspiciously long periods hovering near certain strikes as hedgers lean against small moves.

It's often just a risk-control habit showing up in the tape, and it becomes easier to notice when open interest is large and concentrated.

CryptoSlate has covered similar episodes as the options market has matured, emphasizing that expiry effects are most visible when positioning is heavy and clustered, also noting that the calm can disappear after settlement as hedging pressure resets and new positions get rebuilt.

More traditional market reporting often treats max pain as a reference point while focusing attention on how expiry, positioning, and volatility interact.

The key is that the mechanism itself isn't mystical. A large options stack creates a second layer of trading activity that reacts to spot moves, and sometimes that reactive layer is large enough to be felt by everyone, including people who never touch derivatives.

Options greeks charts, with their stepped shapes, are a visual reminder that sensitivity changes in regimes rather than smoothly. They suggest exposure is concentrated around specific strike regions, so the hedging response can change character as spot crosses those zones.

That's why a single headline number like max pain is usually less informative than a sense of where open interest is thickest, because the thick zones are where hedging flows are most likely to show up as real buying or selling, regardless of what the settlement meme says.

February reshuffles, June anchors, March decides

Mar. 27 is the main event in your snapshot, but the supporting beats matter because they help explain how the March setup can change before it arrives.

The same max pain view shows a meaningful late-February expiry, Feb. 27 (260227), at about $6.14B notional with max pain around $85,000.

It also shows notable size further out, including a high concentration at late June (Jun 26, 260626), which serves as a reminder that positioning is not only about the next few weeks, it is also about the market’s longer-dated posture.

February matters because it's close enough to force real decisions.

Traders who don't want positions to expire often roll them, and rolling isn't just a calendar action, it's a change in where exposure sits.

If February positions get rolled into March, the March pile grows heavier, and the gravity well can deepen. If February positions are closed or shifted to different strikes, March can look less crowded than it does today, and the options map will change in a way that has nothing to do with headlines and everything to do with inventory management.

Either way, February is a likely moment for hedges to be adjusted and for the strike distribution to be reshaped, which is why it deserves attention even in a March-focused story.

June matters for a different reason. Far-dated size tends to decay more slowly and can function like an anchor for risk limits, which can affect how aggressively desks manage near-dated risk in March.

The presence of meaningful longer-dated positioning suggests the market is warehousing views about where Bitcoin could be by early summer. That kind of positioning doesn't dictate day-to-day price, but it can influence the tone of the market around March, including how quickly hedges are rolled forward and how much risk dealers are willing to wear.

So the practical takeaway is that the headline numbers aren't the story on their own.

The $8.65B notional on Mar. 27 and the $90,000 max pain marker tell you there's a crowded event on the calendar, but the mechanism worth watching is where the crowd is standing by strike and how hedging pressure behaves as time shrinks.

The path to March runs through February, when positions can be reshuffled, and it stretches toward June, where longer-dated size can shape how the market carries risk.

None of this replaces macro, flows, or fundamentals, and it doesn't need to. It's a layer of explanation for why Bitcoin can look oddly well-behaved.

When the options stack is this large, you can often see the outlines of the next pressure point in advance, as long as you treat max pain as a rough signpost and focus instead on the crowding that can make price feel sticky in one moment and surprisingly slippery in the next.

The post Bitcoin bears could sleepwalk into a $8.65 billion trap as options max pain expiry nears $90,000 appeared first on CryptoSlate.

On Jan.30, 2026, US spot Bitcoin ETFs saw $509.7 million in net outflows, which looks like pretty straightforward negative sentiment until you look at the individual tickers and realize a few of them stayed green.

That contradiction aged fast over the next few days. Feb. 2 snapped back with $561.8 million in net inflows, then Feb. 3 flipped to -$272.0 million, and Feb. 4 sank to -$544.9 million. The totals went up and down, but the more useful clue was the same one hiding in plain sight on Jan. 30: the category can look like one trade from a distance, while the money inside it moves in very different rhythms.

By the time Bitcoin slid below $71,000, ETF flows and price finally started to rhyme.

If you're trying to read the ETF flow table like a mood ring, the table will definitely mislead you. The total number you see in the table is a scoreboard, not the play-by-play, and it can easily be dragged around by one large exit even while smaller pockets of demand keep persisting. The green islands in the deep red sea are real, but it's rarely the heroic resistance signal people want it to be.

Why “total flows” lie on the days you care most about

Secondary-market trading is people swapping ETF shares with each other, while primary-market creations and redemptions are what change the share count. Flow tables almost always aim at the second layer, the net creation or destruction of shares. The SEC’s investor bulletin makes the key distinction very clear: ETF shares trade on an exchange, but supply changes through the creation and redemption process.

That split matters because a day can see crazy volumes and price action and still print zero flows for a given fund if buyers and sellers just match each other in the secondary market. And a day can print a huge outflow because one or a few large holders decide to redeem, even if there's steady buying elsewhere.

This is why dispersion is worth tracking. Instead of staring at the net number, count how many funds are green versus red, then ask how concentrated the red is. On Jan. 30, the numbers were brutal everywhere: IBIT -$528.3 million versus a -$509.7 million total, which means the rest of the complex was slightly positive when you add it up. FBTC's $7.3 million, ARKB's $8.3 million, and BRRR's $3 million inflows were small, but they were still inflows.

At the beginning of February, we saw a much cleaner example of what broad-based demand looks like and what a concentrated exit looks like.

On Feb. 2, net inflows were spread across the leaders, including IBIT's $142.0 million and FBTC's $153.3 million, BITB's $96.5 million, and ARKB's $65.1 million inflows joining in. That's what a category-wide “buy day” looks like in the flow data: more than one desk, more than one platform, and more than one fund.

On Feb. 3, the table turned into a lesson in internal conflict. IBIT was still up $60.0 million, while FBTC printed -$148.7 million and ARKB -$62.5 million, pulling the total to -$272.0 million. The category was net red while the biggest vehicle stayed green, which is the mirror image of Jan. 30’s story. The takeaway here is not that one ticker smart money and the others aren't, but that the ETF market now has different buyer types with different rules, and they don't all hit the button at the same time.

On Feb. 4, the outflows deepened to -$544.9 million, with IBIT -$373.4 million and FBTC -$86.4 million leading the day, plus smaller outflows across other funds. That was the day Bitcoin dipped under $72,000 in a broad risk-off backdrop.

When analyzing the ETF market, it's important not to treat every green print as fresh conviction. A micro-inflow can be real demand, but it can also be allocation drift getting corrected, a model portfolio topping up a sleeve, or a platform with scheduled behavior that doesn't really care what crypto Twitter is doing this week. Big totals are often driven by a much smaller number of actors than people assume, and small prints can be driven by a much larger number of small accounts than the headlines imply.

The real reasons micro-inflows happen, and what February’s slump did to them

The easiest explanation is the least satisfying and the most frequent: one large redemption can dominate the day. Jan. 30 was a single-ticker gravity well, with IBIT’s $528.3 million outflow overwhelming everything else. Feb. 4 did something similar, with IBIT's $373.4 million outflowdoing most of the work.

Next comes distribution behavior. Some funds get embedded in advisor platforms and model portfolios where allocations update on schedules, sometimes monthly, sometimes quarterly, sometimes when a portfolio crosses a risk band. That sort of demand can remain steady even when fast money is de-risking, and it can show up as small greens on days when the total looks ugly.

Then there's internal switching. Investors rotate between products for reasons unrelated to Bitcoin’s fundamentals: fees, familiarity with a particular issuer, operational comfort, or an institution consolidating exposure for reporting simplicity. A switch day can look like there are buyers in one fund and sellers in another, while the true story is that it's the same exposure, just with a different wrapper.

The Feb. 4–5 slump adds one more ingredient that makes dispersion louder: forced deleveraging in the rest of the crypto market. When the market slides quickly and liquidations pick up, desks that need to raise cash sell what they can, and that can include ETF positions.

That backdrop helps explain why a flow table can look chaotic across tickers even when price action looks like one clean slide into the red. A risk-off day is never just one single decision to sell BTC; it's a pile of different constraints hitting different players at different times.

By Feb. 5, the price drop itself became the headline, with Bitcoin trading around $70,900 after falling below $71,000, and mainstream coverage tying the move to a broader selloff across markets.

So, how do you tell when a green print matters?

A single small inflow on a red-total day is usually weak evidence of anything except the fact that not everyone left at once. It starts to matter when the greens repeat across multiple red-total days, and when the greens broaden across multiple funds, because that tends to mean demand is coming from more than one channel. That is what made Feb. 2 stand out inside this short window.

So when the total is red, ask three questions before you jump to any conclusions.

How concentrated is the outflow, meaning how much of the day is explained by the single biggest red print?

How many funds are green, because broad greens usually mean broader participation rather than one platform doing a scheduled top-up?

And does it repeat, because one day can be calendar effects, routing, or one institution moving size, while repetition is where behavior starts to show?

Jan. 30 taught the core idea with a paradox, and Feb. 3 and Feb. 4 sharpened it. The ETF market is now big enough to hold multiple agendas at once, and the flow table will keep looking contradictory as long as people insist on reading it as one crowd with one opinion.

The post Bitcoin ETF flow numbers are fundamentally broken and most traders are missing the specific sign of a crash appeared first on CryptoSlate.

https://ambcrypto.com/feed/

Bitcoin is at a critical crossroads on the price charts once again.

Bitcoin is at a critical crossroads on the price charts once again. ![Aptos [APT] nears $1-support as $12.7M token unlock raises inflation fears](https://ambcrypto.com/wp-content/uploads/2026/02/Abdul-2026-02-08T115426.777.webp) Discussion around Aptos [APT] printing a fresh low has resurfaced.

Discussion around Aptos [APT] printing a fresh low has resurfaced. https://beincrypto.com/feed/

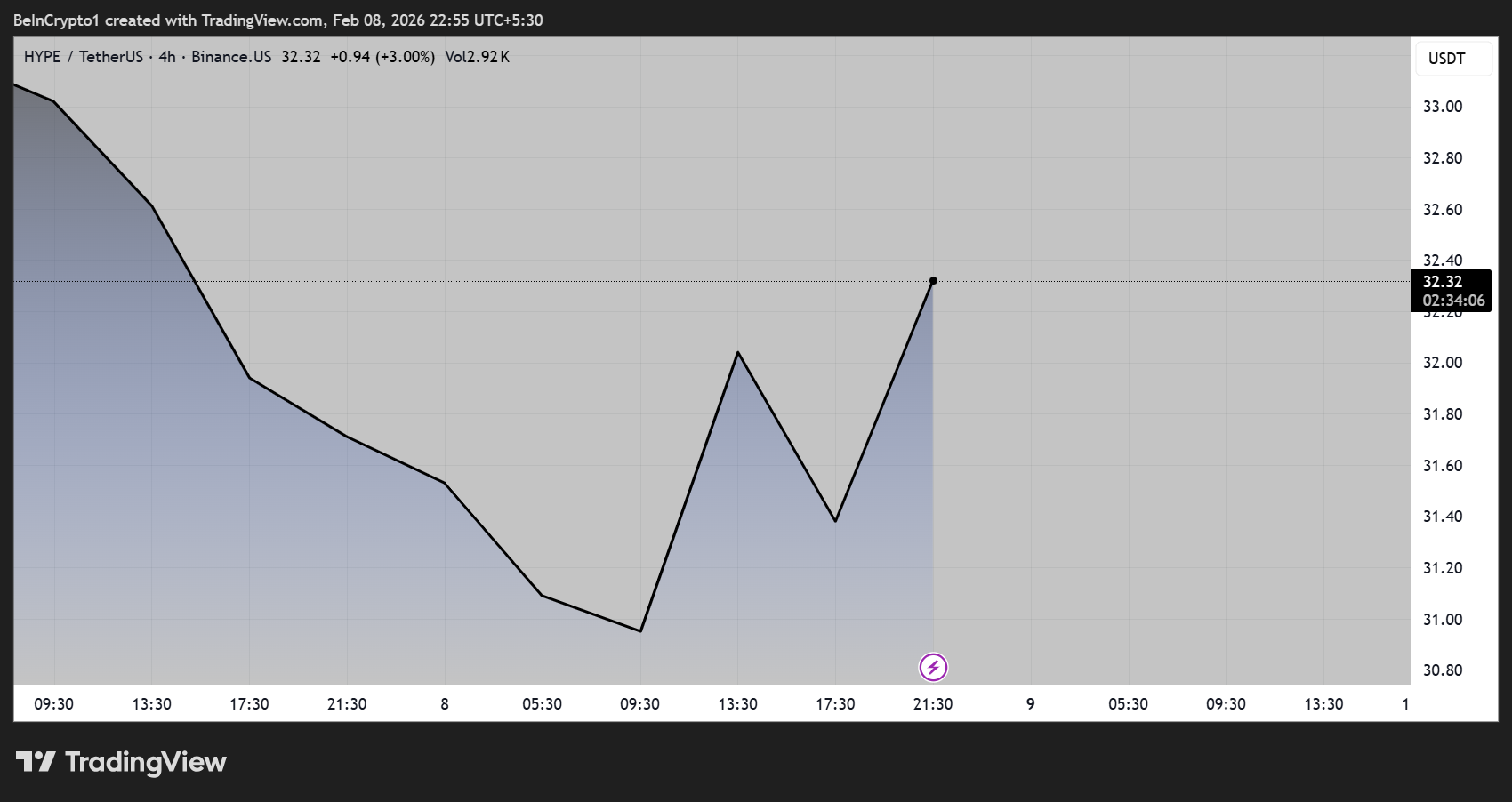

Kyle Samani stepped down from Multicoin Capital on February 5, 2026, after nearly a decade as co-founder. Today, he is publicly criticizing Hyperliquid (HYPE) as on-chain data shows Multicoin purchased over $40 million in HYPE tokens.

The close timing has fueled speculation that internal conflicts over investment strategy prompted the departure of one of the most notable Solana advocates in the crypto industry.

Multicoin, Hyperliquid, and Kyle Samani: Coincidence or Clash?

Samani’s departure announcement on February 5 marked a significant shift for Multicoin Capital, a leading force in institutional crypto investment.

Despite his departure, Samani stated he would remain engaged in cryptocurrency, especially within the Solana ecosystem.

The announcement came only days after MLM analysts flagged wallets believed to be linked to Multicoin accumulating large amounts of Hyperliquid’s HYPE token in late January.

They highlighted purchases totalling tens of millions of dollars. Additional analysis suggests that substantial ETH flows were rotated into HYPE over several days via intermediary wallets.

Notably, no official confirmation has linked the trades directly to Multicoin’s internal strategy decisions.

Today, February 8, just three days after his formal exit, Samani is criticizing Hyperliquid on social media, making his position unmistakably clear.

“Hyperliquid is, in most respects, everything wrong with crypto. The founder literally fled his home country to build Openly, which facilitates crime and terror. Closed source Permissioned,” wrote Samani in a post.

This strong criticism stands in direct contrast to Multicoin’s high-profile investment in HYPE tokens. As a result, observers wondered if Samani’s views clashed with the firm’s recent decisions, helping drive his exit.

Solana Investment Philosophy Versus HYPE Strategy

Multicoin Capital earned its reputation as a vocal backer of Solana. In September 2025, the firm led a $1.65 billion private investment into Forward Industries, working with Jump Crypto and Galaxy Digital to create what they called “the world’s leading Solana treasury company.”

Samani was named Chairman of Forward Industries’ Board, underlining his importance to Multicoin’s Solana focus.

The Solana investment strategy centered on transparent yields through staking, DeFi protocols, and capital efficiency. Multicoin highlighted Solana’s infrastructure as offering better economics than Bitcoin treasury models, citing native yields of 8.05% as of September 2025.

The firm also released research on Solana projects like Jito, which by March 2025 powered over 94% of all Solana stake via custom block production technology.

Hyperliquid, meanwhile, represents a contrasting approach. The platform is a decentralized perpetual futures exchange with its own blockchain.

It is popular for high leverage and low fees, but faces criticism for its centralized validator system, closed-source code, and regulatory risks. These features appear to oppose the principles Samani promoted at Multicoin.

Tensions between strategies became more evident as analysts speculated about internal dynamics.

“Does this mean that they couldn’t buy HYPE as long as Kyle was running the fund, which is why his leaving coincides with Multicoin buying a lot of HYPE?” wrote one user.

Kyle Samani did not immediately respond to BeInCrypto’s request for comment.

Supporters Defend Hyperliquid as Samani’s Exit Sparks Ideological Debate

Some investors and traders pushed back strongly against Samani’s criticism. They argue that Hyperliquid represents a return to crypto’s original principles rather than a departure from them.

Hyperliquid’s decision to direct revenue toward token buybacks and community incentives reflects a model designed to more closely align users and infrastructure than many venture-backed projects.

The divide highlights a deeper ideological split emerging within crypto markets. On one side are investors who prioritize transparency, decentralization, and community ownership as defining principles.

On the other hand, there are those who champion performance, liquidity depth, and institutional-grade infrastructure, even when those systems require trade-offs in governance or architecture.

Samani’s departure itself has not been formally tied to any specific investment decision. Neither Multicoin nor Samani has publicly stated that Hyperliquid or portfolio positioning played any role in the transition.

Sometimes, leadership changes at venture firms often stem from long-term strategic shifts, personal decisions, or fund-structure considerations that may not be visible externally.

Still, the timing has proven difficult for markets to ignore. In crypto, an industry where narratives travel quickly, the combination of on-chain transparency and social media speculation often fills gaps left by limited official disclosures.

Meanwhile, the HYPE token is nurturing a recovery, with a higher low on the 4-hour timeframe, suggesting a trend reversal if buyer momentum sustains.

The post Kyle Samani Slams Hyperliquid Days After Leaving Multicoin appeared first on BeInCrypto.

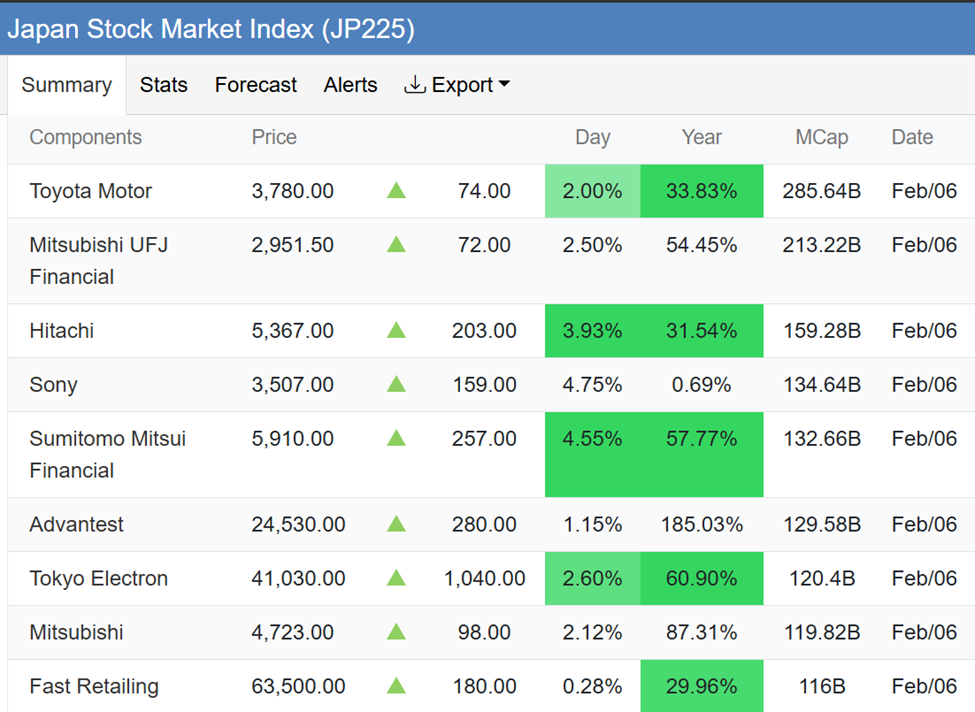

Japan’s Prime Minister Sanae Takaichi, often dubbed the country’s “Iron Lady,” has secured a historic landslide victory in the February 8, 2026, snap parliamentary elections. Her Liberal Democratic Party (LDP) is projected to win between 274 and 326 of the 465 seats in the lower house, marking the largest post-war electoral margin for any Japanese party.

The decisive result consolidates Takaichi’s authority and positions her to pursue ambitious economic and regulatory reforms.

Japan’s Sanae Takaichi Secures Landslide Win, Sets Stage for Crypto Tax Reform

Markets reacted swiftly to the outcome. The dollar/yen climbed 0.2% to 157, while the BTC/JPY trading pair rose almost 5%, signaling investor confidence in Takaichi’s pro-growth agenda.

This so-called “Takaichi trade” draws momentum from expectations of fiscal stimulus, loose monetary policy, and increased liquidity.

It has already lifted Japanese equities to record highs, while government bonds and the yen have faced pressure.

US officials quickly weighed in on the result, with Treasury Secretary Scott Bessent calling the victory “historic” and emphasizing the strength of US-Japan relations under Takaichi’s leadership.

Days before, President Donald Trump also offered a full endorsement, highlighting her leadership qualities and recent trade and security successes.

In turn, Takaichi expressed gratitude, reaffirming plans to visit the White House in spring 2026 and describing the US-Japan alliance as having “unlimited potential” built on deep trust and cooperation.

Takaichi’s Mandate Signals Potential Crypto Tax Overhaul and Blockchain-Friendly Policies

Takaichi’s electoral mandate is widely seen as a green light to accelerate Japan’s crypto reforms. The country currently taxes crypto gains as miscellaneous income at rates up to 55%.

This framework has driven some investors abroad despite Japan’s leading position in blockchain adoption.

Under discussion for fiscal year 2026 are reforms that could:

- Reduce gains tax to around 20%

- Allow loss carryforwards for three years, and

Reclassify certain digital assets as financial products.

The general sentiment is that her pro-growth policies and willingness to collaborate with crypto-friendly opposition parties, such as the Japan Innovation Party and the Democratic Party for the People, could finally push these long-awaited measures through by 2028.

Earlier in her tenure, Takaichi endorsed policies supporting technology, innovation, and economic security, aligning with broader blockchain and Web3 development.

While she has not made crypto a central campaign issue, her aggressive fiscal stance, modeled after her mentor Shinzo Abe’s “Abenomics,” could create an economic environment that favors risk assets, including Bitcoin, Ethereum, and Japan-related digital projects.

“Takaichi has pledged aggressive fiscal policy funded largely through bond issuance…will her electoral momentum fuel even larger stimulus, or give her the political cover to proceed more cautiously, as investors remain uneasy over Japan’s massive debt load and recent spikes across the JGB yield curve,” posed Rob Wallace.

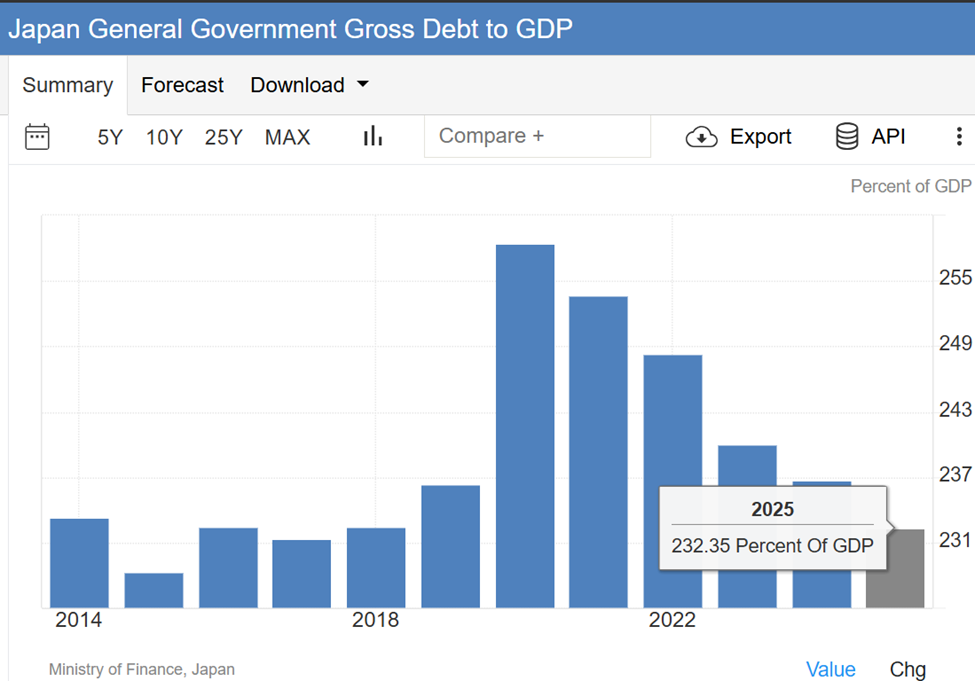

Indeed, uncertainties remain. Japan’s national debt exceeds 250% of GDP after topping out at 232.35% in 2025. Meanwhile, recent spikes in government bond yields have raised investor concerns about fiscal sustainability.

Key cabinet appointments and regulatory priorities will be critical in shaping the pace and scope of crypto reform. Finance Minister Katsunobu Kato’s continued role could maintain policy continuity, though his limited engagement on crypto issues may temper ambitious changes.

Digital Minister Masaki Taira has yet to articulate specific positions on crypto or Web3.

Nevertheless, the Financial Services Agency’s ongoing proposals, combined with Takaichi’s strong political mandate, suggest a turning point for Japan’s digital asset sector.

If successful, reforms could provide clearer regulatory frameworks, tax relief, and legal recognition for crypto, laying the groundwork for a more innovation-friendly ecosystem.

The post Markets and Crypto Eye Policy Reforms As Japan’s Sanae Takaichi Secures Historic Victory appeared first on BeInCrypto.

https://cryptonewsz.com/feed/

https://www.newsbtc.com/feed/

The price of XRP has shown a sheer amount of resilience after a couple of red days for the general crypto market. The altcoin has managed to return to around $1.5 over the weekend, reflecting a nearly 25% jump since reaching its latest local low.

However, this fresh burst of momentum seems to be just that, a short-lived moment of positivity that might not translate to the long-term trajectory. According to the latest on-chain data, the XRP price might still be tilting more towards the bearish side of the market.

Low Funding Rate Signals Reduced Appetite In Derivatives Market

In a recent Quicktake post on the CryptoQuant platform, Arab Chain revealed that belief might be increasingly exiting the XRP derivatives market. This on-chain observation is based on changes in the funding rates on Binance, the world’s largest cryptocurrency by market capitalization.

For context, the “funding rate” metric estimates the periodic fee exchanged between traders in the derivatives market of a particular cryptocurrency. A positive funding rate often signals that the long traders (investors with buy positions) are paying a fee to short traders (investors with sell positions) in the derivatives market, while a low funding rate metric implies that the payment is the other way round.

As shown in the chart above, the XRP funding rate on Binance has been in a notable decline over the past few days, recently dropping to around -0.028, reflecting its lowest level since April 2025. According to Arab Chain, this shift signals a clear move toward defensive positioning and hedging against further downside.

The on-chain analyst revealed that a deeply negative funding rate shows the level of pessimism in the market, as traders are more willing to pay a premium to hold short positions. This trend is even more damaging, considering the decline seen by the XRP price in the past few weeks.

Arab Chain wrote in the Quicktake post:

Historically, funding rates reaching extreme negative levels often coincide with advanced stages of downtrends, when a large portion of traders are already positioned short.

While low funding rates have sometimes set the stage for temporary rebounds triggered by a return of speculative demand, they often reflect heightened caution and reduced risk appetite in the market. Nevertheless, this funding rate level also suggests that any uptick in sentiment could catalyse “faster-than-expected” price moves.

XRP Price At A Glance

As of this writing, the price of XRP stands at around $1.44, reflecting an over 1% decline in the past 24 hours.

Since reaching its current all-time-high price of $126,000 in October last year, the Bitcoin market has been on a sell-off, translating into surmounting bear pressure. As a result, the flagship cryptocurrency has maintained a steady decline, falling until it recently reached $60,000 — a deviation of more than 52% from its all-time high.

Bitcoin currently seems to be seeing a rebound, but price action alone reflects that it could as well be one of its short-term recoveries. Interestingly, a recent on-chain evaluation suggests that the current upward movement may be driven by a significant underlying metric.

What The Bitcoin Sharpe Ratio Is Saying

In a Quicktake post on CryptoQuant, Darkfost reveals that the Bitcoin Sharpe Ratio is now at a zone historically relevant to the ends of bear markets.

The Sharpe Ratio is a risk-adjusted performance metric that measures how much return an asset (Bitcoin, in this case) generates for risk taken. A high ratio signals that returns are strong in relation to risks taken; a declining ratio, on the other hand, reflects weakening returns, while risk remains elevated. On the severe end of the metric, a very low or negative Sharpe Ratio is a sign that market participants are taking very high risks for poor or negative returns. It is worth noting that very low Sharpe ratios are frequently seen during deep bear markets or even capitulation phases.

According to historical data, Darkfost explains that the Sharpe Ratio is currently at a level so low as to be reminiscent of the final phases of past bear markets. This means that the Bitcoin price holds a higher practical risk, compared to returns, for current investors. Notably, the Sharpe ratio is not just at a low point, but continues in a steady state of decline. This, according to the market quant, is a sign that Bitcoin’s performance is yet to be attractive to any willing risk-taker.

However, it is this specific dynamic that sets the pace for a turnaround in Bitcoin’s price. This is because sustained poor returns typically force capitulation events, where weaker hands are flushed out; this eventually sets the stage for renewed accumulation among stronger hands.

Two Main Approaches To Consider In This Scenario: Analyst

Seeing as the current market condition is still mostly uncertain, Darkfost offers two ways to engage the current scenario. First, the analyst states that investors could begin increasing exposure gradually, and in line with the ratio’s movement towards lower risk zones.

Second, Darkfost explains that a market participant could decide to wait for clear improvements in the Sharpe Ratio before entering the market at all. This is to serve as a confirmation strategy for the purpose of investor safety.

However, Darkfost notes that the present bear phase could last a couple more months before any true reversal is seen, regardless of the signal being flashed by the Sharpe Ratio. As of this writing, Bitcoin stands at a $69,064 valuation. CoinMarketCap data reflects a 1.71% loss over the past day.